No-Bitch-No-Bush-No-Bank

Blowing the Whistle, Many Times

WHEN Cynthia Fitzgerald started out in pharmaceutical sales 20 years ago, she received ample training on the right and wrong ways to sell medical products. Right was selling on the merits. Wrong was luring customers with perks and freebies. It was O.K. to buy doctors lunch or dinner, for example, but tempting them with lavish gifts was taboo.

“There were pretty stringent rules back then,” recalls Ms. Fitzgerald, now 50 and a grandmother living in Dallas. “It was really clinically driven.”

But she says those early lessons didn’t serve her so well when she went to work on the other side of the table in 1998, in health care purchasing. Going by the book, and expecting her colleagues and employer to do the same, cost her a job, most of her friendships and several years of her life, she says.

Eventually, Ms. Fitzgerald decided to file what could become one of the largest whistle-blower lawsuits on record. And her case, which names more than a dozen companies as defendants — some with well-known names like Johnson & Johnson, Becton Dickinson and Merck — offers a window onto a little-known world, where billions of dollars’ worth of medical products are sold each year to institutional buyers like hospitals.

The suit, filed in 2003 in federal court in Dallas, and unsealed this year, argues that improper sales practices, together with erroneous accounting, are invisibly draining millions of dollars out of vital public programs like Medicare through overcharges or unauthorized uses. While whistle-blower cases typically involve, at most, a handful of companies, Ms. Fitzgerald’s alleges systemic fraud across a whole network of companies and more than 7,000 health care institutions.

Her contentions are set against a complex backdrop: spiraling health care costs and debates about Medicare. State and federal authorities in Texas are investigating Ms. Fitzgerald’s allegations, and any decision by them to join her case may give the suit momentum in the courts. But her corporate adversaries dispute her accusations.

“Cynthia Fitzgerald is rehashing old rumors and suspicions,” said Jody Hatcher, senior vice president of Novation, the company in Irving, Tex., at the heart of her lawsuit. ”These allegations have been examined in depth by a variety of different authorities, and no one has proven any of them to be true. The simple fact is that Ms. Fitzgerald’s allegations are false.”

For her part, Ms. Fitzgerald bristles at the idea that her lawsuit is without merit or, in response to common critiques of whistle-blower cases, about easy money. “I thought they were really nice people,” she says. “I was so grateful and thankful to have a steady income again. I wouldn’t have rocked the boat for any small thing to save my life.”

So why did she rock the boat?

“It was wrong,” she says of the behavior she asserts she has witnessed. “And I knew it was wrong.”

NINE years ago, while still recovering from a financially ruinous divorce, Ms. Fitzgerald decided to move to Dallas from her native Omaha. She knew almost no one in her new city. She graduated from the University of Nebraska 13 years earlier with a communications degree, then worked in sales and marketing in the food, pharmaceutical and insurance industries.

When she moved to Texas, she says, “It was pretty bleak.” She adds, “I went from having Thanksgiving dinners in a house with my family to living in an apartment that was so small that every time I turned around I ran into myself.”

More than anything, she said, she wanted stability — a steady job at a company where she could climb the ladder and work until she retired. After months of looking, she joined Novation. The company helped thousands of hospitals, rehabilitation centers, home health agencies and doctors’ offices nationwide negotiate prices for medical supplies — a wide range of items as diverse as saline solution and huge imaging machines.

Novation assigned her a portfolio of medical and surgical products for which its member hospitals were spending an estimated $240 million a year: rubber gloves, surgical tools and so forth. The company sent her to a training class where, among other things, she says she learned once again about ethical purchasing procedures.

“I cannot overemphasize in the beginning how excited I was and really feeling blessed,” she says. “I felt like I got a second chance. Even though it was on the other side of sales, it was still sales.”

But as she settled in, she says, not everything in her new workplace squared with what she had been told in training, a situation that came to a head one day in 1998, when she was still just a few months into the job. According to her complaint, she and her boss met with a Johnson & Johnson sales team that was vying for an exclusive, three-year contract to sell $130 million worth of IV equipment to Novation’s clients. It was a valuable contract, and Ms. Fitzgerald had the power to decide who would get it.

The bids were already in. Ms. Fitzgerald understood this to be a mandatory “silent period,” when she was not supposed to meet privately with any of the bidding companies. All communications with vendors were supposed to be in writing, and if Ms. Fitzgerald disclosed any information to any bidder, she was required to tell them all.

In a deposition in a separate lawsuit filed against Novation by a medical supplier, a former Novation executive, John M. Burks, did not dispute that the Johnson & Johnson meeting took place. But he said that Ms. Fitzgerald misunderstood the rules, and that Novation permitted such meetings at that point. (When reached for comment, Mr. Burks said his views haven’t changed since his deposition.)

Ms. Fitzgerald says she had a very different understanding of the meeting. Discussions behind closed doors, tipping off a company on how to structure a winning bid, naming her price — this could be a felony, she recalls thinking :bid-rigging.

“How much will it take to get the contract?” she says one of the salesmen asked her, according to her complaint. “Others before you have done it.”

Photo

Cynthia Fitzgerald calls medical-supply fraud “systemic.” Credit Brian Harkin for The New York Times

She says she chose not to do so. “Oh, no!” she recalls blurting out, bringing the meeting to a halt. “This is illegal, and I don’t look good in orange.”

A spokesman for Johnson & Johnson, Marc Monseau, said, “We vigorously deny the allegations and will defend ourselves against them in court.”

Ms. Fitzgerald did not stop there. After the salesmen left, she says, she confronted her boss in the women’s room. Shouldn’t they report the incident to the legal department? Hadn’t they just been told that someone at Novation had taken a bribe?

Her boss offered no satisfaction, Ms. Fitzgerald says in her complaint. Concerned about the integrity of a bidding process she was responsible for, she began pursuing the matter herself.

OVER the following weeks, she says, she scoured her portfolio for contracting anomalies. She told colleagues about what had happened; some confided that similar things had happened to them. Others left anonymous notes on her desk. She began to think that Johnson & Johnson should be excluded from the bidding as a penalty for what she considered a serious ethical breach.

She says she took her concerns to Novation’s legal department, human resources and even the company’s president. In his deposition, Mr. Burks confirmed her activities, but called her “an employee who doesn’t simply understand that when a supplier asks an inappropriate question, you simply say no and move on.”

Ms. Fitzgerald says she passed over Johnson & Johnson for the IV contract, awarding it instead to Becton Dickinson. She said Becton had a superior bid, which provided a number of opportunities for Novation and member hospitals to be rewarded with rebates and other payments.

Becton said it believes that Ms. Fitzgerald’s accusations of improprieties in how contracts were awarded are baseless and that her complaint is “without merit.”

She turned to the next contract, for trash bags — and the same thing started to happen, according to her complaint. When Ms. Fitzgerald told representatives of one vendor, Heritage Bag, that she was planning to put that contract up for bid, she says, one representative told her at dinner with several people that he would “take care of” her. Heritage Bag did not respond to repeated requests for an interview.

Ms. Fitzgerald asked her supervisor if she could be taken off the trash-bag contract. Her supervisor agreed, but then gave her a negative performance review. It said that among other things, she was rude, unable to meet deadlines and kept trying to “overhaul” parts of Novation that were outside her job description, according to a copy of the review. Ms. Fitzgerald refused to sign it. Relations deteriorated, and 15 days later, she was fired for “nonperformance of duties that were clearly identified as part of her job description,” according to Mr. Burks’s deposition.

Ms. Fitzgerald says she believes she was shown the door because she had stumbled onto illegal behavior involving hundreds of millions of dollars and had refused to look the other way.

“It’s hilarious how stupid I was,” she says. “I knew that it was wrong, but I thought that if I just went to the right people, they would correct it. I was very naïve. I didn’t realize that it was systemic.”

Advertisement

Continue reading the main story

The False Claims Act is a federal law that allows private individuals to sue on behalf of the United States if they believe that they have inside knowledge of a fraud. Their lawsuits stay under court seal at first, to give federal and state investigators time to look into the accusations quietly and to decide whether to join the case. If the government recovers money, the whistle-blower gets 15 to 30 percent of the amount.

Though enacted to fight war profiteering, the False Claims Act has become a potent weapon in the battle against escalating health care costs. Of the 20 largest False Claims Act recoveries listed on the Web site of Taxpayers Against Fraud, a group that supports whistle-blowers and their lawyers, 19 involved health care companies. (The other involved municipal bonds.)

The size of recoveries has soared in recent years. All told, the government has recovered more than $20 billion since 1986, when the False Claims Act was last amended, with $5 billion of it in the last two years.

The biggest single whistle-blower settlement to date was the $900 million that Tenet Healthcare, a hospital company, paid last year to settle accusations of overbilling the Medicare program. That settlement is dwarfed by the $1.7 billion that HCA, another big hospital chain, paid between 2000 and 2003 to settle a number of fraud suits.

Jeb-Bush-Novation-Dead-US Attorneys

Companies and their lawyers say the growing caseload is a sign that the False Claims Act, with its promise of a payout for whistle-blowers, is motivating disgruntled employees to file nuisance suits that can tie up law-abiding companies for years.

Proponents of the law say that $20 billion of recoveries is proof that contracting fraud is real, and that offering whistle-blowers a percentage is a good way to compensate them for the near-certainty that they will be fired.

“Protection for people who are willing to risk their lives and livelihoods, their careers and reputations, is critical,” said Richard Blumenthal, the attorney general of Connecticut, in Senate hearings last year.

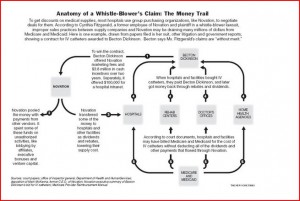

As Ms. Fitzgerald sees it, Medicare’s losses grow out of the way that Novation and the vendor companies negotiate contracts.

When companies submitted bids to Novation, she recalled, they did not typically quote a simple price. Rather, they proposed package deals with opportunities for rebates, frequent-buyer discounts, “loyalty” rewards and baskets of products tied together. They might throw in free training for hospital staff, chances to participate in clinical trials, shares of stock, project sponsorships, sometimes even cash. The vendors also paid Novation for administering their contracts and for other services.

Ms. Fitzgerald says her compensation rewarded her for closing deals that maximized these payments — not for simply finding the lowest bid. Vendors preferred to combine higher upfront prices with rebates or other cash-back rewards, she says, because that obscured the net unit price of their products, making it harder for hospitals to comparison-shop.

But this also allowed millions of dollars to become “lost” in the system, she says. Novation passed on many of the payments to hospitals, she says, but not in a way that hospitals could accurately report them to the government. Thus they ended up overstating their supply costs, she says, and getting larger Medicare reimbursements than they were entitled to. The lawsuit does not contend that the hospitals did this deliberately, but that Novation knew it was happening.

A 2005 audit by Daniel R. Levinson, the inspector general of the federal Department of Health and Human Services, appears to bear her out. After studying the finances of three unnamed purchasing consortiums in response to repeated questions from Congress, federal agencies and the news media about their business practices, Mr. Levinson reported that their member hospitals “did not fully account” for such flows of money. In just five years, the discrepancies ran into the hundreds of millions of dollars.

Novation said that there was no evidence that any underreporting was intentional. It cited the complexity of how hospitals are required to report costs and said it believed that hospitals met all legal requirements in how they reported Novation’s distributions to them.

In the past, a prosecutor’s decision whether or not to join a whistle-blower lawsuit could be a make-or-break moment. If the government became involved, defendants often settled right away. The announcement usually coincided with the unsealing of the whistle-blower’s complaint.

But now that the lawsuits have become so complex, and investigations so slow, judges have become impatient with sealed lawsuits moldering in their courts. Some are ordering the complaints unsealed before investigators finish examining the claims.

That is what happened in Ms. Fitzgerald’s case. Last May, a federal judge in Dallas unsealed her suit, which had languished for four years. The assistant United States attorney for the Northern District of Texas , Sean R. McKenna, and the Texas attorney general, Greg Abbott, notified the court that they were still investigating and would decide later whether to join the case.

THAT leaves Ms. Fitzgerald on her own for now. After Novation fired her, she was contractually forbidden from disclosing information about the company or filing lawsuits against it for three years, she says. Once that period lapsed, she gradually became aware she was eligible to file a suit under the False Claims Act. That led her to Phillips & Cohen, a law firm involved in whistle-blower cases.

Her firing, meanwhile, left her unable to get another job in her field; word of her demise at Novation seemed to precede her wherever she went. Former colleagues stopped speaking to her. “I was probably at one of the lowest points in my life,” she says.

She eventually founded her own business, Dimension Medical Supply. But she regrets the contentious departure from Novation, a company that made her feel as if she “was coming home” when it hired her. Deciding to speak out about the company’s dealings was difficult, she says.

“I warred with myself,” she says. “There weren’t any blacks in upper management. I knew that there were opportunities there, and I could rise to those opportunities.”

She was tempted, she says, to follow the status quo at Novation. And a little voice in her head kept saying, “Why can’t you just take the money and run? Buck up, girl, this is the system. You can take it and go places.”

In the end, the place she decided to go was court.

http://www.nytimes.com/2007/11/18/business/18whistle.html?_r=1

US Attorneys Deaths tied to Jeb Bush

http://www.stewwebb.com/2014/10/03/federal-judges-coverup-u-s-attorneys-deaths-tied-jeb-bush-part1

Related Jeb Bush Crimes against America

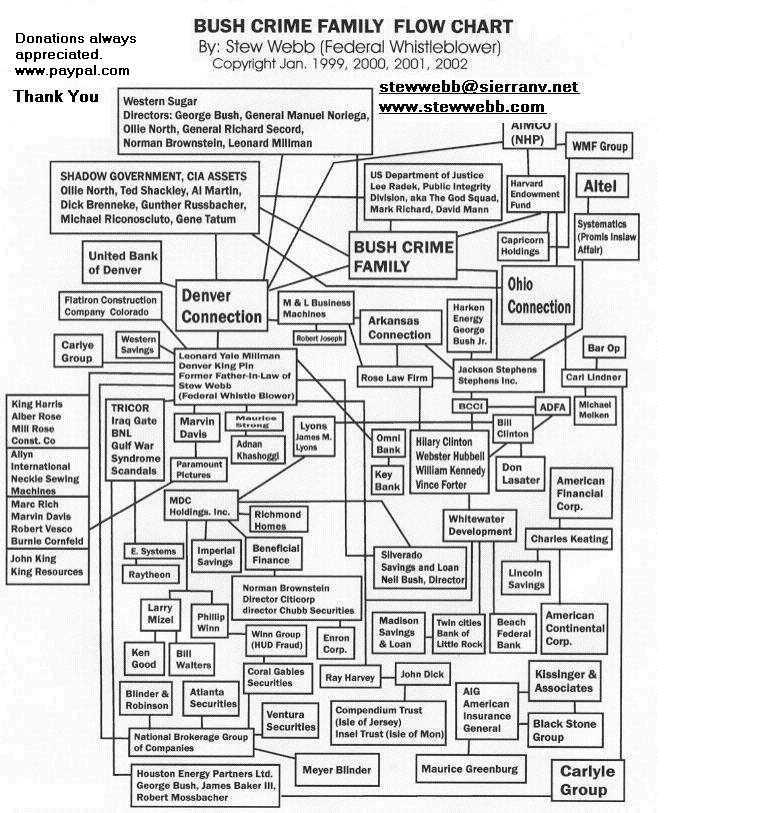

Bush Clinton Organized Crime Chart #1

http://www.stewwebb.com/2013/08/11/bush-millman-clinton-zionist-organized-crime-family-flow-chart-1

Stew Webb Federal Whistle blower Grand Jury Demand against Jeb Bush

http://www.stewwebb.com/2015/01/05/stew-webb-grand-jury-demand-kerre-millman-attempted-murder

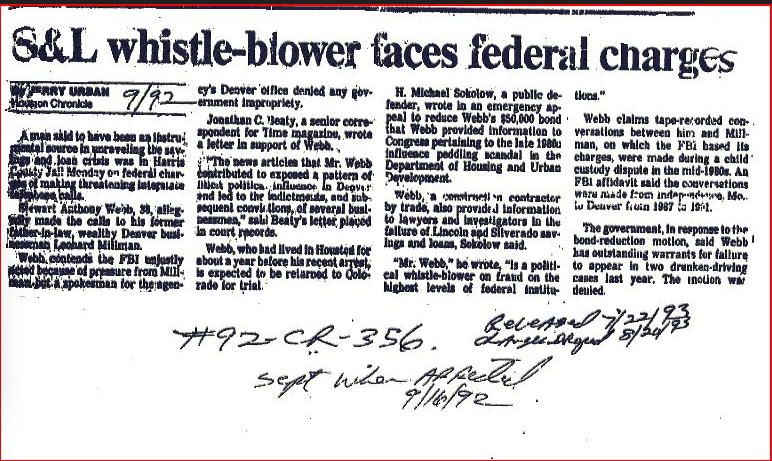

Saving and Loan whistle blower faces federal charges

http://www.stewwebb.com/2013/10/08/sl-whistleblower-faces-federal-charges

Stew Webb Official SEC Whistle blower Complaint Mortgage Backed Securities Fraud

Note: HSBC Bank and MDC Holdings, Inc, (MDC-NYSE)

http://www.stewwebb.com/2013/10/07/stew-webb-official-sec-whistleblower-complaint-mortgage-backed-securities-fraud

Kerre Millman Denver’s Illuminati Princess Manipulator Liar Attempted Murderer

http://www.stewwebb.com/2015/01/06/kerre-millman-denvers-illuminati-princess-manipulator-liar-attempted-murderer

AIPAC Operated Child Sex Blackmail Ring of U.S. Congressmen and U.S. Senators

FBI Whistle blower Exposes Jeb Bush as Drug Lord

http://www.stewwebb.com/2014/02/22/fbi-whistleblower-darlene-novenger-exposed-george-hw-bushs-drug-usage

US Attorneys Deaths tied to Jeb Bush

http://www.stewwebb.com/2014/10/03/federal-judges-coverup-u-s-attorneys-deaths-tied-jeb-bush-part1

Bush Clinton Body Count from Iran Contra

http://www.stewwebb.com/2013/10/23/bush-clinton-body-count-from-iran-contra

Jeb Bush Crimes against America

http://www.stewwebb.com/?s=Jeb+Bush&submit=Go