Too Big to Fail: The “FDIC” Federal Deposit Insurance Corporation Went Bankrupt Last Summer. The Financial Media Say Nothing.

Gary North

Jan. 28, 2010

According the the FDIC, the FDIC is broke. It has been broke since before September. You can see for yourself here.

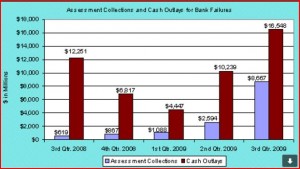

In September, the FDIC was $8.2 billion in the hole: red ink. By now, it’s far more in the hole. In June, it was $10.3 billion in the black. Year to year, September to September, it lost $42.8 billion.

The FDIC has been kind enough to provide a graph.

The FDIC has released the summary and the graph, yet Sheila Bair, who runs it, has said nothing. Instead, after the results were known, she gave a speech to bankers in November in which she said that“too big to fail” must be scrapped by the government.

We’ve had too many years of unfettered risk-taking, and too many years of government subsidized risk. It’s time we changed the rules of the game. It’s time we closed the book on the doctrine of too big to fail. Only by instituting a credible resolution process and removing the existing incentives for size and complexity can we limit systemic risk, and the long-term competitive advantages and public subsidy it confers on the largest institutions.

The FDIC is too big to fail. If it were allowed to fail, there would be a true run on the banks. People would demand currency. The banks could not deliver the currency. They would fail. We would get a replay of 1930-33. She knows it. The Federal Reserve economists know it.

In late August, when the FDIC was busted, she gave a speech with this assurance.

Now let me turn to how failures are affecting the Deposit Insurance Fund, or the DIF. First: failures cost money. And the costs are charged to the DIF. But one thing that you should know is that the DIF balance has already been adjusted downward for the cost of failures that are expected to occur over the next year. Just as banks set aside reserves for loan losses, we set aside reserves for anticipated bank failures.Our total reserves — consisting of both the DIF balance and a contingent loss reserve — are available to absorb losses. The DIF balance reflects the net worth of the insurance fund. It’s also a guide for setting deposit insurance premiums for our industry-funded system. So when a bank fails, to the extent that we have already reserved for a failure, the loss comes out of the contingent loss reserve. For example, when Colonial Bank failed two weeks ago … there was no reduction in the fund because the estimated loss had already been reserved for.

We review the adequacy of the contingent loss reserve every quarter, and make adjustments as warranted. As illustrated in this chart, we have been shifting large sums to the contingent loss reserve as our failure projections have grown. The total reserves are now over $42 billion.

FDIC resources run deep

Our total reserves should be distinguished from the cash resources at our disposal to protect depositors. As this last chart shows … our sources of liquidity to protect depositors in future failures include not only the $22 billion of cash and Treasury securities held by the DIF as ofJune 30, but also the ability to borrow up to $500 billion from the Treasury. To sum up, a decline in the fund balance does NOT diminish our ability to protect insured depositors.

The T-bills were gone when she gave the speech. She referred to June. But June was long gone.

Deception? Big time! From a woman who postures herself as the conscience of the banking system.

Congress has been bailing out the FDIC for six months.

One pro-Bair site as late as October 15 wrote this of her position.

The fact that Sheila Bair–the only top regulator in this country who’s been outspoken about the causes of the crash–can’t turn to either the Obama administration or to Congress to replenish the FDIC’s fund is a symptom of just how sick our system is. She’s betting that things will get better between now and next year, that new financial regulation will be in place, that the economy will turn a corner, and that Congress and the American people won’t view a request from her to replenish the FDIC’s fund with taxpayer money as a taxpayer bailout that marks her as the same kind of leach as Kenneth Lewis of Bank of America or Franklin Raines of Fannie Mae.

By that time, the FDIC was already receiving funds from the government.

The press says nothing.

The FDIC too big to fail. Taxpayers and buyers of Treasury debt will pay. So will people who don’t factor in inflation.

The news media know. There is a cover-up going on in plain sight. They stay silent.

Nobody cares. Americans are beyond the point of caring. The deficit numbers are huge, and they keep growing. Americans believe in cost-free government debt.

Stew Webb Radio