GLOBAL CROSSINGS SOLD TO CHINA COMPANY THAT RUNS PANAMA CANAL

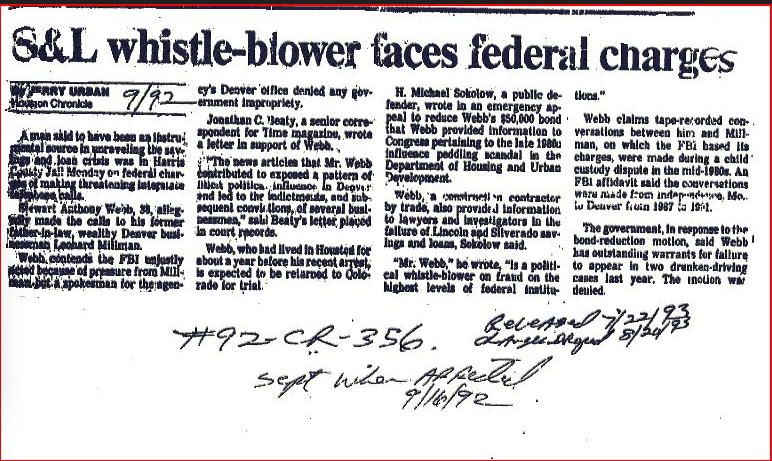

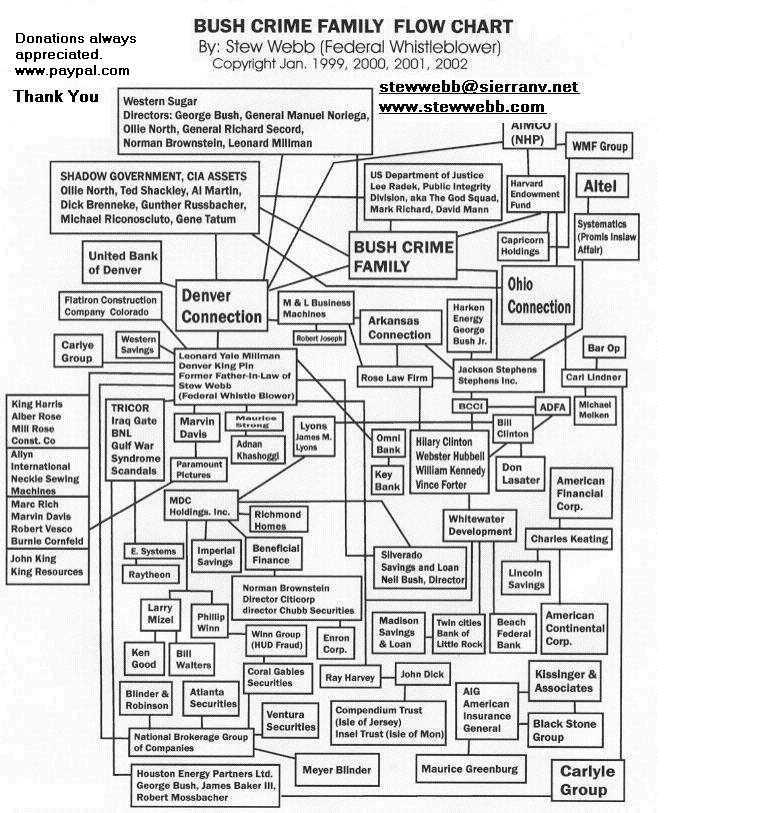

(Note from Stew Webb: USAG William Barr worked as a Assistant Attorney to then CIA Director George HW Bush from 1975-1977

Bill Barr’s direct Boss was then CIA Attorney Norman Brownstein of Denver, Colorado.

Norman Brownstein an AIPAC American Israeli Political Action Committee Director was on the Board of Directors of Global Crossings and Silverado Savings and Loan when they both collapsed of fraud.)

Norman Brownstein this same man is also on the Board of Global Crossing Ltd.

the other big recent bankruptcy

for your info…if you didn’t know already

DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth the names, ages and positions of our executive officers, director nominees and directors whose term of office will continue after the annual meeting. Additional biographical information concerning these individuals is provided in the text following the table.Name Age Position

—- — ——–

Gary Winnick……………… 53 Chairman of the Board and Director

Lodwrick M. Cook…….. 72 Co-Chairman of the Board and Director; Chairman, Global Marine Systems

Thomas J. Casey……… 49 Vice Chairman of the Board, Chief Executive Officer and Director

Mark Attanasio………. 43 Director

Norman Brownstein……. 57 Director

Joseph P. Clayton……. 51 Director;

President and Chief Executive Officer, Global Crossing North America

William S. Cohen…….. 60 Director

William E. Conway, Jr… 51 Director ( Carlyle Group )

Eric Hippeau………… 49 Director

Geoffrey J.W. Kent…… 58 Director

Maria Elena Lagomasino.. 52 Director

Gary A. Cohen……….. 44 President and Chief Operating Officer, Global Crossing Solutions

Dan J. Cohrs………… 48 Executive Vice President & Chief Financial Officer

John L. Comparin…….. 48 Executive Vice President, Human Resources

S. Wallace Dawson, Jr… 55 Executive Vice President, Global Network

James C. Gorton……… 39 Executive Vice President & General Counsel

Joseph P. Perrone……. 52 Executive Vice President, Finance

GLOBAL CROSSINGS SOLD TO CHINA COMPANY THAT RUNS PANAMA CANAL

A.K. Pritchard Republican@ ideasign.com

with Carl Limbacher www. newsmax.com

Friday, Aug. 9, 2002

Hutchison Whampoa Snags Global Crossing Hutchison Whampoa, the mammoth company that runs the Panama Canal and has close ties to the Chinese army, has a new rhinestone in its crown: Global Crossing. Along with another Asian company, Singapore Technologies, it paid $250 million today for the bankrupt fiber-optic network company – a third of the original offer. “An outside financial adviser to Global Crossing who was called to testify at a hastily scheduled hearing early Friday said only three credible bids had been received during a lengthy auction process and that bidders were spooked by the ongoing collapse of the business,” the Associated Press reported. “It’s a very difficult world today in the telecommunications industry,” said Arthur Newman, the senior managing director in charge of the restructuring for Blackstone Group.

(Note from Stew Webb: Drug Money from Iran-Contra Silverado Savings and Loan Denver Colorado Neil Bush Director proffered up Blackstone Group which owns the Federal Reserve.)

The Asian companies agreed to invest $250 million in Global Crossing’s business, and to pay $300 million in cash and issue $200 million in notes to its creditors. “The investors will hold a controlling 61.5 percent stake in the new Global Crossing that emerges from bankruptcy, possibly early next year,” AP said. Global Crossing is the fourth-largest bankruptcy in U.S. history. Observations: A Chinese company with ties to the Red Army snaps up the company known for its fishy ties with Democrat national chairman Terry McAuliffe, Bill Clinton’s boy. Clinton was notorious for the payments he received from the Chinese. Thanks to an insane giveway by another Democrat president, Jimmy Carter, Hutchison Whampoa controls the Panama Canal. Why has Hutchison Whampoa’s purchase of Global Crossing received almost no media attention? —————————— A.K. Pritchard The Republican Web pages and email list “And to the Republic for which it stands”

Global Crossing battles accounting controversy

By Chidi@ idg.com

February 8, 2002 4:32 pm PT

A WAILING CHORUS of investors have joined a former Global Crossing Holdings financial vice president in criticism of the accounting practices of this provider of telecommunication services. Together, the picture they paint portrays the company’s executives as negligent at best, and purveyors of fraud at worst.

In a press release issued Monday, Roy Olofson, former vice president of finance for Global Crossing, accused company executives of improperly describing the company’s revenue to the public. Olofson, through his attorneys at Los Angeles law firm O’Neill, Lysaght & Sun, said Global Crossing improperly recorded long-term sales immediately rather than over the term of the contract, that the company improperly booked swaps of capacity with other carriers as cash transactions, and that Global Crossing fired him when he blew the whistle.

His attorney said all Olofson wanted to do at first was fix the books. Now he wants restitution for his lost job, but he is unlikely to get it from Global Crossing itself — which is under bankruptcy protection. Olofson isn’t suing anybody yet, but he’s thinking about it.

In a separate action, the Los Angeles law firm of Weiss & Yourman LLP filed a class-action lawsuit on Monday against five of the company’s top executives. The suit charges them with violating federal securities laws by participating “in a fraudulent scheme and course of business …. by disseminating materially false and misleading statements and/or concealing material adverse facts.”

Because Global Crossing is under bankruptcy protection, Olofson cannot sue without the court’s permission. Class-action lawsuits against the company require permission as well. That is why the class-action suit targets the executives themselves. If he files suit, Olofson would likewise sue company executives.

Other class-action lawsuits over Global Crossing’s meltdown are also in the works.

Global Crossing said in response to Olofson’s public statements that it reviewed Olofson’s accusations and found them without merit. The company has reported its financial results in accordance with the law and is cooperating with a U.S. Securities and Exchange Commission (SEC) probe triggered by Olofson’s allegations and the bankruptcy filing, a spokeswoman said.

She would not comment on a Friday report from USA Today which said the U.S. Federal Bureau of Investigation is also probing Global Crossing’s accounting practices, nor would she comment beyond the company’s press releases.

Global Crossing’s bankruptcy, declared in January, is the largest of any telecommunication company to date, and the fourth-largest in U.S. history. The $22.4 billion claimed in liabilities in its bankruptcy filings in the U.S. Bankruptcy Court for the Southern District of New York and the Supreme Court of Bermuda dwarf the debts of high-profile meltdowns in the previous year like those from NorthPoint Communications Group, Rhythms NetConnections, and PSINet.

Global Crossing’s investors face the loss of substantially all of their investment in the proposed bankruptcy restructuring.

Hutchison Whampoa and Singapore Technologies Telemedia said in January that they would bail out Global Crossing with an investment totalling $750 million. In exchange they will become the new owners of the company, if the courts agree to the terms.

Existing common equity and preferred shareholders receive nothing for their investment if the Hutchison and Singapore Technologies deal goes through. The deal would leave the company comparatively debt-free, wiping away most of its liabilities. Bondholders would share in a combination of cash, new debt, and new equity in the restructured company.

Global Crossing took on about $7.2 billion in debt over three years until 2000 to build 1.7 million miles of fiber-optic cable. With Internet use exploding, the company wanted to build an Internet protocol-based network to open the most narrow bottlenecks connecting transoceanic regions. The company completed its international network of fiber-optic data transport capacity in June 2001 with the connection of Lima, Peru, to the company’s South American cross-connection. Their network today spans 27 countries and 200 major cities.

With a market capitalization of more than $40 billion and a share price of about $50 in 1999, the company’s billions of dollars of debt looked manageable. But as other carriers began to enter the market and the economy foundered, demand for Global Crossing’s capacity waned.

Company executives began to play games with the books in 2001 in order to keep meeting the company’s performance goals as stated to the financial markets, according to both the class-action suit and to a statement Olofson issued through his attorneys.

Olofson was a vice president of finance for the company, responsible for preparing financial statements and SEC filings. After returning to work in May 2001 after a five-month leave of absence to fight lung cancer, he raised some concerns about the company’s accounting practices to his superiors, he said through his attorneys.

Both the class-action suit and Olofson’s accusations cite the presentation of revenue from capacity swaps and indefeasible rights of use, or IRUs, as issues. Carriers sell an IRU to allow another carrier or company the unfettered use of the capacity over a long period of time. Generally accepted accounting principles (GAAP) require companies to record the revenue generated by an IRU over the time of the contract.

This change to GAAP rules came in 1999, amid concerns that companies were too easily using IRUs to disguise revenue problems. Olofson claims Global Crossing was misleading investors by presenting new, more favorable accounting metrics alongside GAAP results and hyping the more favorable figures as more representative of the company’s performance.

Global Crossing created metrics called “cash revenues” and “adjusted EBITDA” in press releases. Global Crossing’s cash revenue measurement was defined as GAAP revenue plus the cash portion of the change in deferred revenue. Like pre-1999 accounting rules, it allowed the company to talk about all the revenue for an IRU up front, according to Olofson’s attorneys.

It is kind of like a landlord reporting as revenue all the rent for a year in the first month of a lease. Given the corporate financial flameouts of the last year, presenting all the revenue as an up-front gain hides the real risk of a customer trying to cancel the contract or going bankrupt.

The adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) figure was used to monitor the company’s compliance with its bondholders, the big banks and investment firms watching the company to see whether it was bringing in enough money to cover its debts.

Olofson felt that massaging the press releases to present favorable figures to the press and analyst community is one thing, but that improper accounting for capacity swaps were another matter.

Global Crossing recorded a $100 million sale of capacity to Qwest Communications International in the first half of 2001 as cash revenue, even though Qwest sold about the same about of capacity to Global Crossing in exchange, Olofson’s attorney said.

“As I understand it, it’s not illegal in and of itself. It’s how you treat it,” said Paul Murphy, an attorney representing Olofson from O’Neill, Lysaght & Sun. “There might be a benefit to the company … but that’s different from saying you’re getting cash.”

Additionally, Olofson said in Monday’s statement that he discovered several other irregularities, including one in which Global Crossing recorded a $150 million IRU sale of capacity as deferred revenue — revenue owed to the company though not in hand. Global Crossing bought $200 million of capacity from the customer in exchange for $50 million in cash and $150 million of capacity. Because the carrier was going bankrupt, Global Crossing did not bother to hand over any cash at all, fearful of receiving less than promised in return, nor did it receive any cash, Murphy said.

“Under GAAP, you have to exchange the money,” he said. “They didn’t even exchange the money.” Deals like this seemed to come near the end of financial quarters when the company needed to make its revenue numbers, Murphy said.

Olofson first brought up his concerns questioning the inclusion of the $150 million in cash revenue and adjusted EBITDA and the Qwest transaction in May 2001, according to Monday’s statement. He met face-to-face with his boss, Joseph Perrone, executive vice president for finance.

Perrone had been hired away from Arthur Andersen a year earlier. At Arthur Andersen, Perrone was the partner in charge of overseeing Global Crossing’s audit.

Arthur Andersen, now under fire for its alleged mishandling of bankrupt energy trader Enron’s books, audited both Global Crossing and Qwest. Qwest didn’t book the capacity swap as a sale but Global Crossing did, Olofson alleges in the statement. If outside analysts compared notes, they would see the discrepancy and take aim at Global Crossing’s accounting practices, Olofson said in the statement.

Perrone subtly threatened Olofson’s job at the meeting, Olofson’s attorney said.

Olofson’s attorney said Perrone was the gatekeeper of information between the company and Arthur Andersen, preventing the accounting firm from a proper look at the books. He noted that no mention of Olofson’s allegations was made to Arthur Andersen until after the story broke in the Los Angeles Times in January 2002, almost six months after Olofson first made them.

Olofson sent an e-mail to the president of the company and other financial officers, discussing his concerns. After refusing to work with Perrone, he was placed on administrative leave and eventually fired, his attorney said.

Global Crossing said it cut his job along with 1,200 others in a November restructuring. In a release responding to Olofson’s charges, it attacked his motives, saying that Olofson is looking to bolster his case for a potential wrongful termination suit with his charges of corporate malfeasance, and that Olofson demanded a multimillion dollar settlement.

The Weiss & Yourman suit names as defendants Gary Winnick, Global Crossing chairman of the board; Dan Cohrs, chief financial officer; Thomas Casey, vice chairman and former chief executive officer; David Walsh, president and chief operating officer; and Joseph Clayton, president and chief executive officer of the company’s North American operations.

The suit notes the size and timing of stock sales by some of the defendants, particularly Winnick’s. Winnick sold about 10 million shares of Global Crossing — about 9 percent of his stake in the company — for $123.5 million between January and October of 2001, the period the suit alleges the executives were making misleading statements.

Winnick’s sales were bound by a collar, meaning that in exchange for a minimum price for the sale, Winnick gave up the right to sell at higher than a maximum price, “thereby evidencing his belief that the share price was likely to decline and unlikely to rise,” according to the suit.

Winnick’s personal press relations spokesman did not return a call seeking comment.

The fallout from the Global Crossing bankruptcy has spread throughout the telecommunication sector, as investors worry about a company’s financial exposure to Global Crossing, or whether more accounting irregularities will surface in other companies.

In light of recent accounting scandals plaguing Enron, Tyco International and Kmart, Olofson’s accusation likely has attracted more attention on Wall Street than it would have otherwise drawn.

WorldCom has taken a beating in recent weeks, losing half its market value since January 1 and its stock is trading near six-and-seven year lows. WorldCom’s Chief Executive Officer Bernard Ebbers felt it necessary to tell investors on Thursday at a scheduled quarterly conference call that the company had comparatively little income reported from IRUs, that its exposure to Hamilton, Bermuda-based Global Crossing was less than $10 million, and that it had few financial creations like the special purpose entities allegedly used by Enron to hide debt.

The Global Crossing class-action plaintiffs’ attorney points an accusatory finger at Arthur Andersen as well as carrier itself, though without naming the accountancy in the suit.

“Look at who the accountants were. Arthur Andersen,” said Joseph Weiss, lead attorney in the class action lawsuit from Weiss and Yourman. “Who were the accountants for Enron? Who were the accountants for Tyco? … I think that’s all that needs to be said.”

George A. Chidi is a Boston-based correspondent for the IDG News Service, an InfoWorld affiliate. Stacy Cowley in New York contributed to this report.

All logos and trademarks in this site are property of their respective owner.

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: <http://www.law.cornell.edu/uscode/17/107.shtml