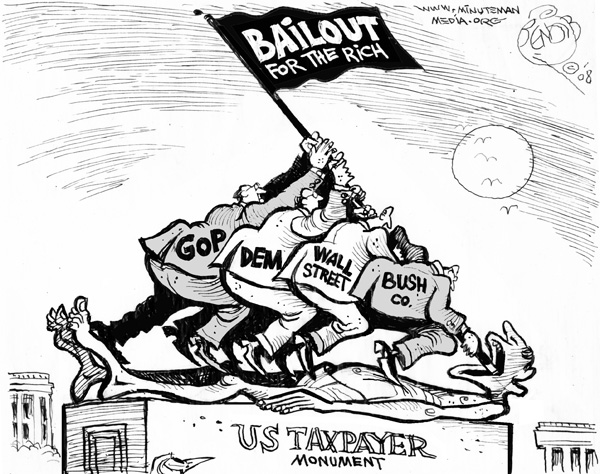

TARP Bailout 23 Trillion

and Rising...

Breaking News July

20, 2009

As reported by this Federal Whistleblower-Stew Webb the same people who have looted the Savings and Loans and been involved in many other National Scandals and Crimes are the same Bush-Millman-Lindner-Clinton Crime Syndicate Criminals Looting the Government once again in the Bank Bailout TARP.

TARP Bailout $23.5 Trillion and Rising

Leonard Yale Millman alive, faked his death in 2004, Set

up MDC Holding, Inc. in 1972 with Larry Mizel as his "front" stooge,

"cutout", buffer, to hide Millman's identity and illegally laundering

money from the American Jewish Millman Mob to

Leonard Yale Millman alive, faked his death in 2004, Set

up MDC Holding, Inc. in 1972 with Larry Mizel as his "front" stooge,

"cutout", buffer, to hide Millman's identity and illegally laundering

money from the American Jewish Millman Mob to  Larry

A. Mizel MDC Asset Investors, Denver Colorado the Main entity and culprit in the

illegal Sub-Prime TARP Bank Bailout scamming the U.S. Treasury and the American

Taxpayer. I Stew Webb have contacted every Inspector General, I. G. TARP, I. G.

Treasury, I. G. SEC, I. G. FDIC, U.S. Senators, U.S. Congressmen and Barack

Obama who refuse to Bust these Criminals and are

covering this up. I have followed the Millman illegal money trail for 27

years and have the evidence the Obama Justice Department refuses to acknowledge. They

created Mortgages and duplicated the sale 9 times on the same Mortgage to Wall

Street Investors. These are the thieves who stole your Pension Funds.

Larry

A. Mizel MDC Asset Investors, Denver Colorado the Main entity and culprit in the

illegal Sub-Prime TARP Bank Bailout scamming the U.S. Treasury and the American

Taxpayer. I Stew Webb have contacted every Inspector General, I. G. TARP, I. G.

Treasury, I. G. SEC, I. G. FDIC, U.S. Senators, U.S. Congressmen and Barack

Obama who refuse to Bust these Criminals and are

covering this up. I have followed the Millman illegal money trail for 27

years and have the evidence the Obama Justice Department refuses to acknowledge. They

created Mortgages and duplicated the sale 9 times on the same Mortgage to Wall

Street Investors. These are the thieves who stole your Pension Funds.

(See: above this Breaking News Section for more details on the Bankers Con Game.)

Be sure to click below to read full story:tarp_bailout_23_trillion_072009.

___________________________________________________

Big Estimate, Worth Little, on Bailout

http://www.cnbc.com/id/32025494

Just how much could the bailout of the financial system end up costing American taxpayers?

Neil M. Barofsky, the special inspector general for the Troubled Asset Relief Program set up by the Treasury Department, came up with the largest number yet in testimony prepared for delivery Tuesday to a House committee. “The total potential federal government support could reach up to $23.7 trillion,” he stated.

But in the report accompanying his testimony, Mr. Barofsky conceded the number was vastly overblown. It includes estimates of the maximum cost of programs that have already been canceled or that never got under way.

It also assumes that every home mortgage backed by Fannie Mae or Freddie Mac goes into default, and all the homes turn out to be worthless. It assumes that every bank in America fails, with not a single asset worth even a penny. And it assumes that all of the assets held by money market mutual funds, including Treasury bills, turn out to be worthless.

It would also require the Treasury itself to default on securities purchased by the Federal

|

The sheer unreality of the number did not stop some members of Congress from taking the estimate seriously.

“The potential financial commitment the American taxpayers could be responsible for is of a size and scope that isn’t even imaginable,” said Representative Darrell E. Issa of California, the ranking Republican on the House Committee on Oversight and Government Reform, which will hold the hearing. “If you spent a million dollars a day going back to the birth of Christ, that wouldn’t even come close to just one trillion dollars — $23.7 trillion is a staggering figure.”

Mr. Issa’s staff distributed a briefing memo for Republicans on the committee that quoted the testimony relating to the $23.7 trillion number, but did not mention any of the qualifications contained in the report.

In an interview Monday evening, Mr. Barofsky said he did not view his testimony as misleading. (He also defended his work in an interview with CNBC. See video).

“We’re not suggesting that we’re are looking at a potential loss to the government of $23 trillion,” he said. “Our goal is to bring transparency, to put things in context.”

http://www.cnbc.com/id/32025494 (click here to see video on original page)

Asked what he thought the maximum total cost could be, he replied that it was not his job to estimate that, and declined to give a figure.

Mr. Barofsky has no authority to investigate most of the programs he discussed. He came up with far smaller numbers for the Troubled Asset Relief Program, known as TARP, that he is charged with monitoring. Of the $700 billion appropriated by Congress, the Treasury has so far spent $441 billion, and about $70 billion of that has been repaid.

“TARP does not operate in a vacuum,” Mr. Barofsky said in his prepared testimony. To properly evaluate that spending, “the context of these broader efforts” must be considered.

That $23.7 trillion figure would amount to about $77,000 for every person in the United States, and would be almost $10 trillion more than the country’s entire economic output, which is $14.1 trillion.

To reach that figure, Mr. Barofsky added up all possible Federal Reserve programs, and got a total of $6.8 trillion. He figured the TARP program could end up costing $3 trillion, including possible spending by the Federal Deposit Insurance Corporation and the Fed.

For those totals to be reached, every dollar invested by the government in banks would have to become worthless, and the banks would have to default on securities guaranteed by the F.D.I.C. All the collateral posted by the banks to get loans from the Fed would also have to become worthless.

Added to those figures are $4.4 trillion in other possible Treasury programs, and $2.3 trillion in F.D.I.C. guarantees of deposits. The final $7.2 trillion comes mostly from various mortgage-related programs.

Even if all those numbers somehow turned out to be accurate, the report conceded that the total would be smaller because “there is potential for double-counting of exposures where different federal agencies provide guarantees for the same financial institutions.”

The report does not appear to discuss how total government obligations are increased when the Fed either guarantees or purchases Treasury securities. In the interview, Mr. Barofsky declined to address that question.

Andrew Williams, a spokesman for the Treasury Department, called the figures “distorted” because they did not consider the value of the collateral posted for loan programs, as well as the value of securities the Treasury has received from banks.

“These estimates of potential exposures do not provide a useful framework for evaluating the potential cost of these programs,” Mr. Williams said, according to Bloomberg News. “This estimate includes programs at their hypothetical maximum size, and it was never likely that the programs would be maxed out at the same time.”

He added that the United States had spent less than $2 trillion so far, and that much of that was backed by valuable assets.

It may be the first time that $2 trillion appears to be a small number.

ENEMY OF THE AMERICAN PEOPLE

TO BIG TO FAIL IS THE BANKSTERS-MAFIA CON GAME

THIS IS THE LARGEST FINANCIAL HEIST IN U.S. HISTORY

Bank Bailout Four Main Culprits The American Jewish Mafia-Mossad

June 12, 2009 Grand Jury Actions Have Begun to Bring The Rule Of Law And Justice for All Americans and Jail The Bush-Millman-Lindner-Clinton Crime Syndicate

For Illegal Bank Bailouts, Americans Pension Funds Stolen, Murders Of U.S. Attorneys, Illegally Disbarred Attorneys, Obstruction Of Justice, Frauds Upon The Court, Justice Department Obstructions and Cover-ups, Blackmail of Congress and Senate, Illegal Political Prosecution of Whistleblowers, Attempted Murders, Stolen Elections, Judicial Cover-ups, Kidnapping Of Children, Iran-Contra, Iraq-Gate, War Crimes, Economic Plunder, Crimes against Humanity, Treason and Sedition.

Justice For All Americans

United States Federal Grand Jury Case Number 95-Y-107 Active

whistleblower_launches_legal_fund.

Be sure to click below to view Court Filings and Progress of All Americans Grand Jury

Stew Webb Active Grand Jury Case Number 95-Y-107

Grand Jury Demand July 1 2003 .

Media and Senate Ignores Dead U.S. Attorneys and Payoffs to former Attorney General John Ashcroft over Bushes theft of Medicare-Medicade Frauds Estimated at $1 Trillion Dollars since 2000

two_dead_u_s_attorneys_john_ashcroft_gets_paid_off.

senate_ignored_5_texas_us_attorney_death_and_firings.

texas_us_attorney_deaths_raise_foul_play_questions.htm

dead_ fired_attorneys_linked_to_white_house.htm

http://www.medicalsupplychain.com/news.htm

ENEMY OF THE AMERICAN PEOPLE

TO BIG TO FAIL IS THE BANKSTERS-MAFIA CON GAME

THIS IS THE LARGEST FINANCIAL HEIST IN U.S. HISTORY

gov_bailout_hits_8.5_tillion1.jpg

government_bailout_hits_$8.5_trillion.

Bank Bailout Four Main Culprits The American Jewish Mafia-Mossad

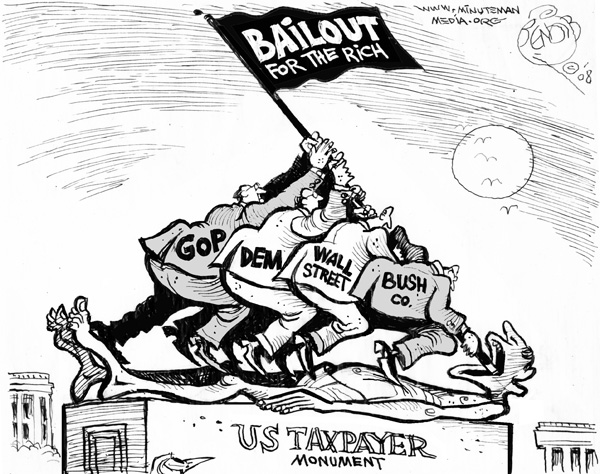

Bank Bailout Organized Crime Syndicate Criminals left to right top: Leonard Millman (faked his death in 2004), Larry Mizel, Norman Phillip Brownstein, Maurice Hank Greenburg.

Organized Crime Partners and Co-Conspirators George W. Bush, Hillary Clinton, Bill Clinton, George H. W. Bush

Criminal

Co-Conspirator U.S. President Barack Obama foreign born Barry Soetero

bush_narcotics_money_laundry_funds_obama_mccain.

barack_obama_were_is_justice_for_bush_and_clinton.

Bush_Millman_Clinton_Lindner_Crime_Family_Flow_Chart1.

sub_prime_bailout_us_treasury_theft.

Inside The Bush Crime Family Part2.

Inside The Bush Crime Family Part1.

savings_and_loan_whistleblower_faces_federal_charges_091692.gif

Charges dismissed after being held as a American Political Prisoner for 10 1/2 months because I was classified as a National Security Threat for Exposing these criminals.

Secret Documents Order of Dismissal Aug 93 92 CR 356.jpg

Leonard Yale Millman who replaced Meyer Lanksy as the American Jewish Mafia Crime Boss Hog Laundered Trillions of Dollars of Illegal Narcotics and Weapons monies since the late 1940s for Meyer Lansky, Carl Gambino, John Gotti and George H. W. Bush aka Iran-Contra.

Millman ratted out Bugsy Siegel to Meyer Lansky while Millman was acting as the accountant for Meyer Lansky building the Flamingo Hotel in Las Vegas, Nevada which got Siegel killed in the late 1940s, Leonard Yale Millman replaced Bugsy Siegel.

http://en.wikipedia.org/wiki/Meyer_Lansky

http://en.wikipedia.org/wiki/Bugsy_Siegel

http://en.wikipedia.org/wiki/Devil%27s_Den_(game)

Meyer

Lansky

Meyer

Lansky Bugsy

Siegel

Bugsy

Siegel Leonard

Millman faked his death

in 2004

Leonard

Millman faked his death

in 2004

Organized Crime Figures Leonard Millman and his Organized Crime Boss Hog replacement Larry Mizel are looting the U.S. Treasury with the current Bank Bail Out. They created Mortgages and duplicated the sale 9 times on the same Mortgage to Wall Street Investors. These are the thieves who stole your Pension Funds. Read the links below to view their past Crimes and being protected by George H. W. Bush, Bill Clinton, George W. Bush and now Barack Obama.

American Jewish Mafia Crime Boss Hog Larry A. Mizel CEO MDC Holdings, Inc. Denver, Colorado, Controlled and interlocked with AIG, CITI Group, Bank of America, Key Bank, MDC Asset Investors and controls over 6000 plus Major Corporate entities including failed Silverado Savings and Loan (Neil Bush Director), Richmond American Homes and Beneficial Finance all built and purchased with Narcotics Money Laundering.

As one Israeli Mossad Agent stated; Stew, we are not Jews we are Israelis the Satanic Illuminati Zionists Council of 13 Bankers your ex in law Leonard Millman among the others have tried to label us as Jews in the same way the Illuminati Zionists such as George H. W. Bush have labeled Americans as Right Wing, Left Wing, Conservatives and Liberals in order to Conquer and Divide.--Stew Webb

All logos and

trademarks in this site are property of their respective owner. FAIR USE NOTICE: This site contains copyrighted

material the use of which has not always been specifically authorized by the

copyright owner. We are making such material available in our efforts to advance

understanding of environmental, political, human rights, economic, democracy,

scientific, and social justice issues, etc. We believe this constitutes a 'fair

use' of any such copyrighted material as provided for in section 107 of the US

Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on

this site is distributed without profit to those who have expressed a prior

interest in receiving the included information for research and educational

purposes. For more information go to: www.law.cornell.edu/uscode/17/107.shtml